By: Husam Yaghi

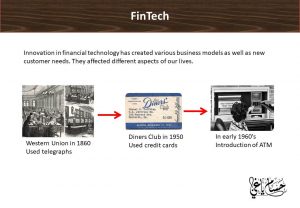

“Financial technology or “FinTech” describes the use of new and disruptive technology in financial services.” FinTech is not a new concept, but part of an evolution.

Western Union used the telegraph technology to transfer money as Back as 1861 in USA. Banks are responding to the FinTech threat by either acquisitions, partnerships, or rejection and fight.

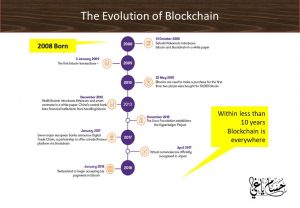

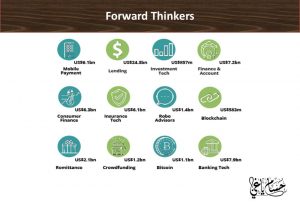

The FinTech buzz word gained popularity after the 2008 after the global financial crises started. With lack of trust in conventional banks, people were ready for an alternative. PayPal, Stripe, Prosper, and others ceased the opportunity. These new comers proved to be cheaper, faster, and much more user friendly. Innovation in financial technology has created various business models as well as new customer needs. They affected different aspects of our lives.

Now we have: Cryptocurrency, mobile-only banking, P2P payments, and Crowdfunding. One could open a bank account and do all her banking without ever visiting a branch.

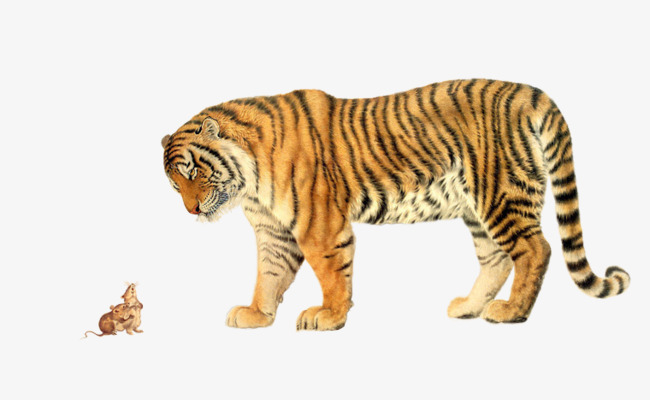

It is natural for traditional financial institutions to fear this disruption. 80% of top executives believe that their firms are at risk of displacement from FinTech startups.

No doubt, FinTechs are reshaping banking, payment, and the perspective of money. There are barriers and roadblocks to widespread business adoption of FinTech. Traditional banks cannot cater to the unbanked segment.

Most banks have been facing the crucial problem of not catching up; despite reaching for help from major consulting organizations.

The obvious win-win solution for all is “collaboration”.

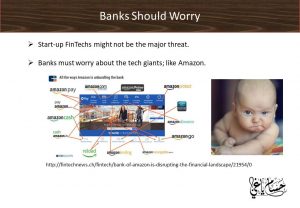

The major threat is not coming from FinTechs, rather from platform giants; like: Amazon, Apple, Alibaba, and possibly soon Uber, Facebook, and others. These giants have great customer data and know how to make the most of it. They know how to bridge the value chains of various industries and blur sector boundaries.