By: Husam Yaghi

Having observed the transformation of century-old financial institutions unfold over recent years, one thing has become crystal clear: becoming AI-native isn’t a luxury for banks anymore; it’s survival. Artificial intelligence isn’t just coming to banking; it’s redefining what banking can be.

The Human Cost of Legacy Systems

Ola, a loan officer at a local bank in Riyadh, used to spend her Mondays drowning in paperwork. “I’d come in early just to get through the weekend’s mortgage applications,” she told me during an interview. “Some days, I couldn’t even look customers in the eye because I was so buried in forms.”

This human toll of outdated systems plays out in thousands of banks daily. Behind every “system is down” message or “please wait 3-5 business days” is a story of frustration, both for employees and customers.

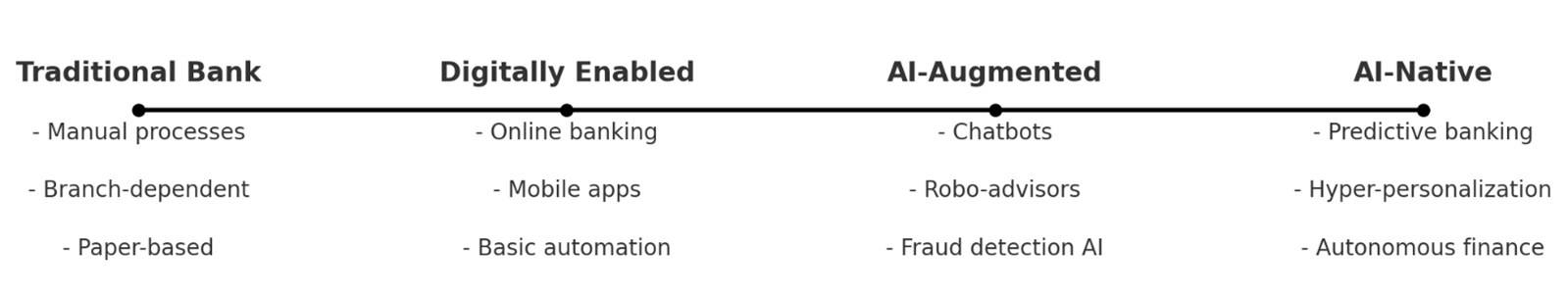

Banking’s Technological Journey

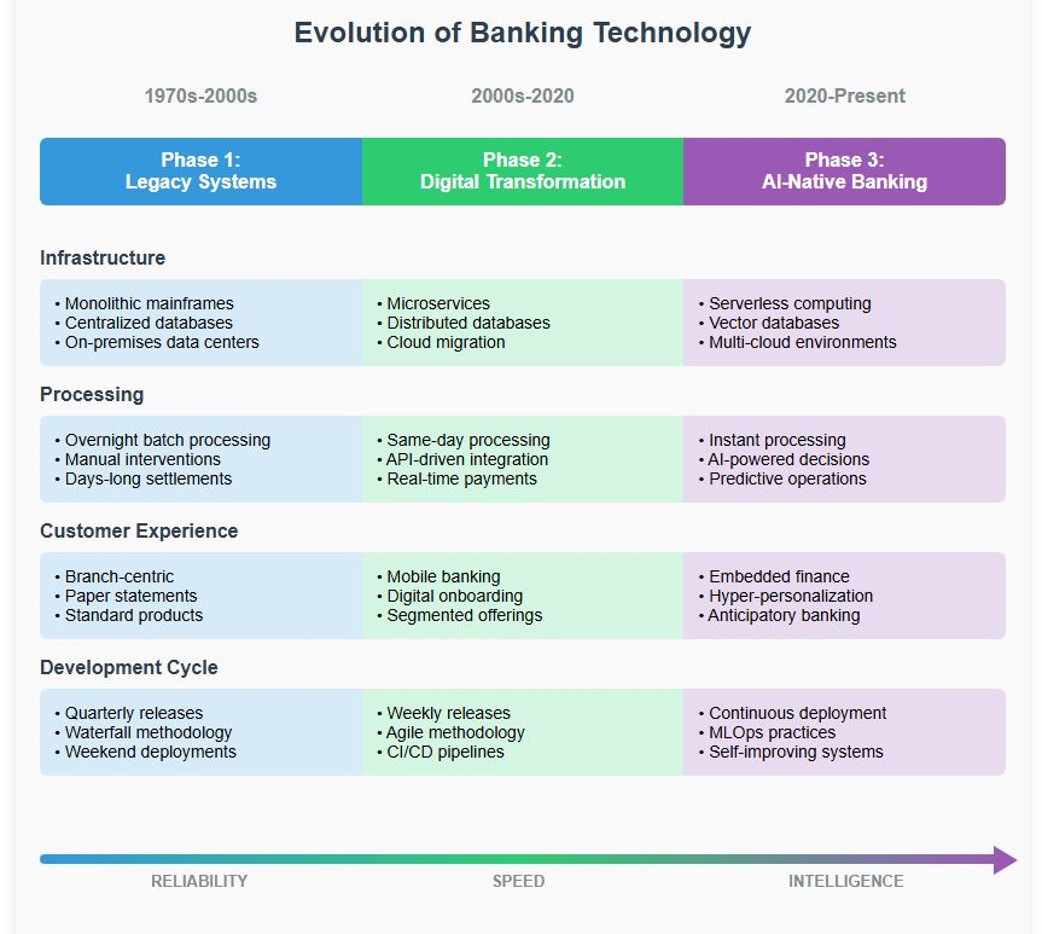

Phase 1: The Era of Mainframes and Midnight Batch Processing

Banking technology’s first chapter was written in the language of COBOL and executed on massive mainframes housed in temperature-controlled rooms. These systems, many still running today, were revolutionary in the 1970s but are now technological relics.

Ihsan Yaghi, a retired Arab Bank executive, recalls those early days: “We’d run batch processes overnight when the bank was closed. The mainframe would churn through thousands of transactions sequentially. If something went wrong at 3 AM, you’d get a call and drive to the data center to fix it.”

These systems were designed for a world where:

-

Banking hours were strictly 9-to-5

-

Updates happened quarterly, not daily

-

A “fast response” meant same-day service

-

Data existed in isolated silos

-

Changes required months of planning and weekend-long maintenance windows

Despite their limitations, these systems have proven remarkably durable. The banking industry runs on approximately 800 billion lines of COBOL code today; a testament to their reliability, if not their flexibility.

Phase 2: The Digital Awakening

The digital transformation era marked banking’s first major technological reinvention. Forward-thinking institutions began breaking down monolithic systems into microservices; small, independent components that could be updated individually.

Tamara, CTO at a mid-sized bank that completed this transition in 2020, explains the shift: “We went from quarterly releases to daily deployments. Our mobile app went from being a glorified ATM locator to the primary way most customers interact with us.”

This phase introduced critical innovations:

-

Cloud-native architectures replacing on-premises data centers

-

API-first designs enabling partnerships with fintechs

-

Real-time payment capabilities

-

Data lakes unifying previously siloed information

-

DevOps practices accelerating software delivery cycles

-

Continuous integration/continuous deployment (CI/CD) pipelines

But digital transformation, while necessary, was ultimately just a prelude to the true revolution.

Phase 3: The AI-Native Revolution

We’ve now entered banking’s third technological era; one where AI isn’t just a feature but the foundation. In AI-native banks, intelligence is woven into every process, every decision, and every customer interaction.

In AI-native banking, we’re completely reimagining what those processes should be in the first place.”

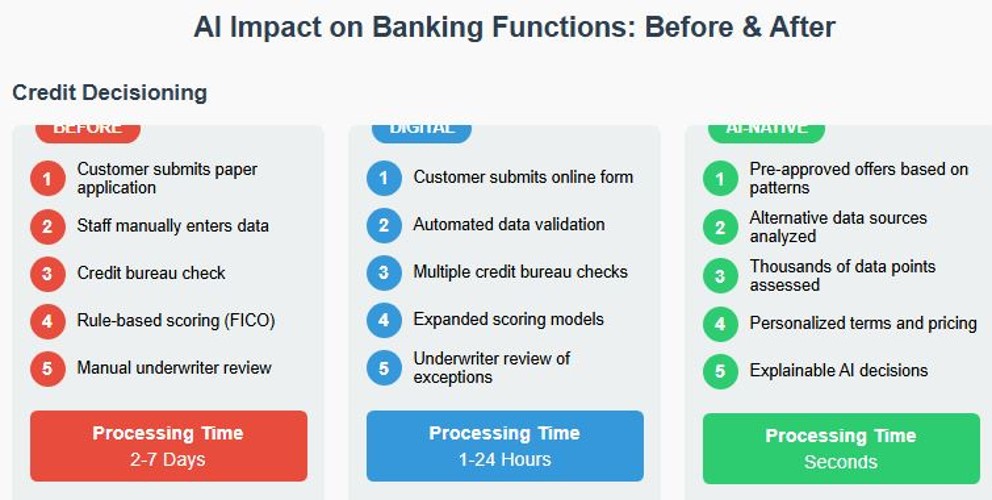

Consider how AI transforms these fundamental banking functions:

Credit decisioning: Traditional banks might take days to approve a loan application, following rigid criteria. Digital banks reduced this to hours with online applications. AI-native banks can provide personalized offers in seconds, using thousands of data points to assess risk while explaining decisions transparently.

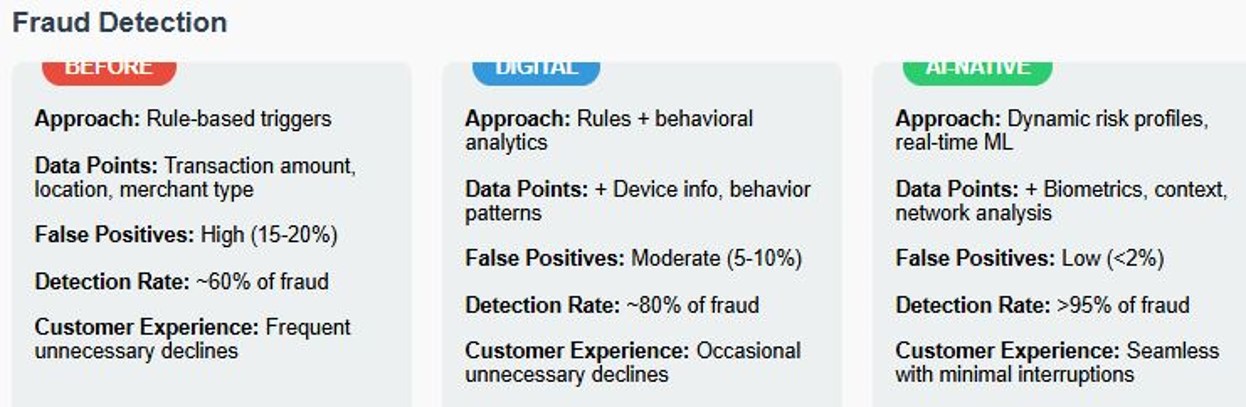

Fraud detection: Legacy systems relied on rule-based triggers that generated numerous false positives. Digital systems added behavioral analytics. AI-native systems create dynamic risk profiles that evolve in real-time, identifying sophisticated fraud patterns while drastically reducing false alarms.

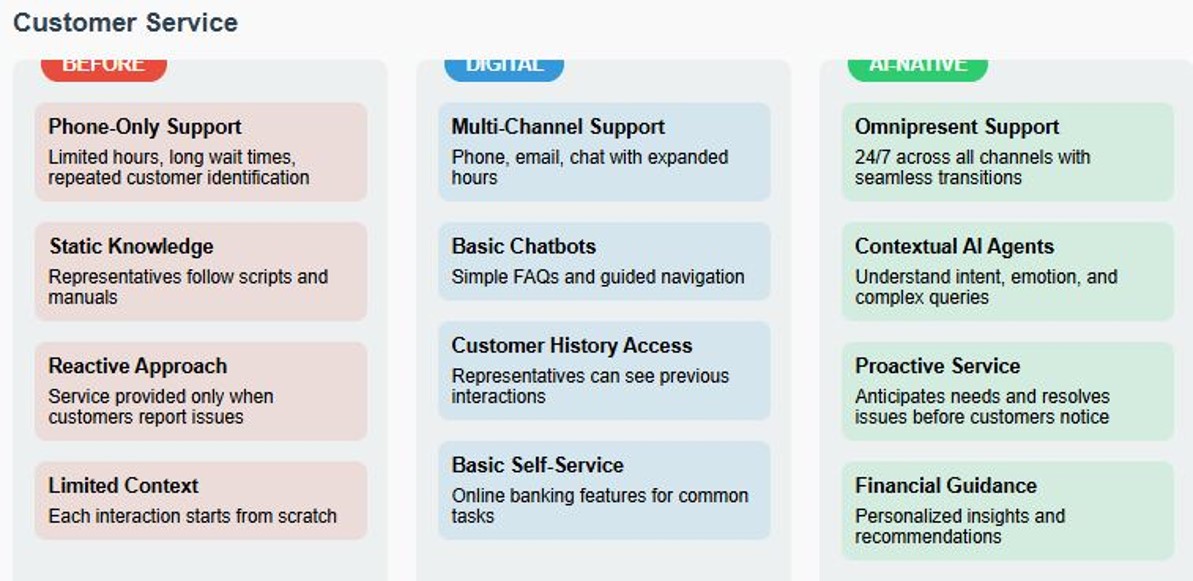

Customer service: The evolution from phone-only support to chatbots has now yielded to AI agents that understand context, emotion, and intent; often resolving issues before customers even recognize them.

Seven Pillars of AI-Native Banking Excellence

For banks serious about transformation, seven critical capabilities must be developed, each requiring specific technical infrastructure:

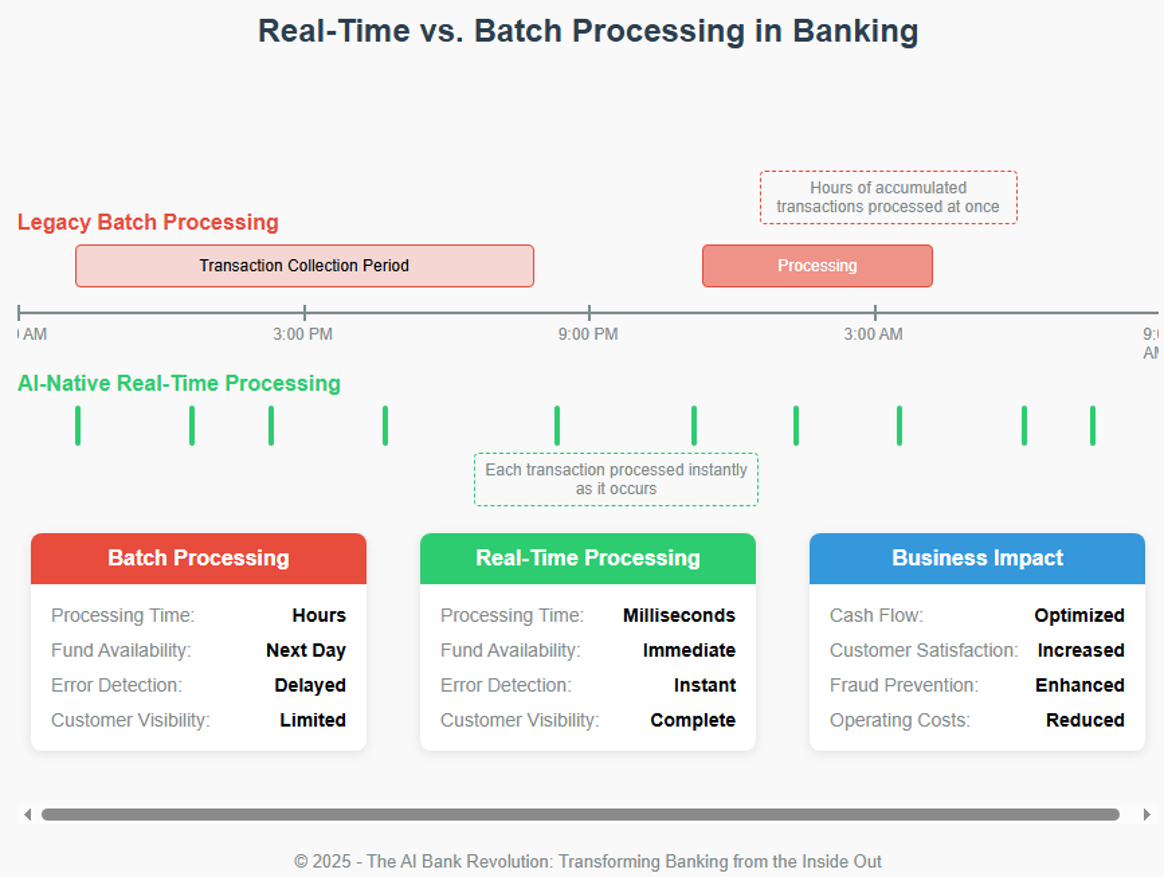

1. Real-Time Transaction Processing

The human impact: For small business owner Chee Fong, the difference was life-changing. “I used to wait until Friday to run payroll because I needed to be sure all customer payments had cleared. Now transactions settle instantly, and my cash flow forecasting is actually reliable.”

Technical requirements:

-

Event streaming platforms (like Apache Kafka or Confluent)

-

In-memory computing grids

-

Change data capture (CDC) systems

-

Real-time ledger architectures

-

Low-latency messaging systems

2. Five-Nines Reliability (99.999% Uptime)

The human impact: “Banking is infrastructure,” says financial inclusion advocate Ola Yaghi. “When systems go down, people can’t buy groceries, pay rent, or access their medicine. Five-nines isn’t a technical metric; it’s about human dignity.”

Technical requirements:

-

Active-active multi-region deployments

-

Automated failover mechanisms

-

Chaos engineering practices

-

Site reliability engineering (SRE) teams

-

Redundant connectivity paths

-

Self-healing infrastructure

-

Degraded mode operation capabilities

3. Hyper-Personalization at Scale

The human impact: “My bank now feels like a financial advisor who really knows me,” explains recent college graduate Amir Johnson. “When I got my first job, they didn’t try to sell me a generic savings account; they helped me balance student loan payments with retirement saving in a way that made sense for my specific situation.”

Technical requirements:

-

Vector databases for semantic search and recommendation

-

Customer data platforms (CDPs)

-

Real-time decisioning engines

-

Natural language understanding (NLU) systems

-

Federated learning capabilities

-

Privacy-preserving analytics

-

Explainable AI frameworks

4. Continuous Product Evolution

The human impact: Product manager Lisa Winters contrasts her experience: “At my previous bank, launching a new credit card took 18 months. Now we can test a new feature with a small customer segment in the morning and roll it out globally by afternoon if it resonates.”

Technical requirements:

-

Containerized microservices architecture

-

Kubernetes orchestration

-

Feature flagging infrastructure

-

A/B testing platforms

-

Canary deployment capabilities

-

API versioning standards

-

Automated regression testing

5. Ecosystem Integration

The human impact: “Banking used to be a destination,” notes financial advisor Amer Sian. “Now it’s embedded everywhere. My clients don’t ‘go to the bank’ anymore; banking comes to them exactly when and where they need it.”

Technical requirements:

-

API management platforms

-

Developer portals and sandboxes

-

Webhook infrastructure

-

OAuth/OpenID Connect implementation

-

Partner onboarding automation

-

Rate limiting and quota management

-

Third-party risk management systems

6. Continuous AI Learning

The human impact: Fraud analyst Ali Babtain saw the difference immediately: “We used to update our fraud models quarterly. By then, the criminals had already moved on to new techniques. Now our systems adapt daily, sometimes hourly, staying ahead of emerging threats.”

Technical requirements:

-

MLOps infrastructure

-

Model monitoring and drift detection

-

Feature stores

-

Distributed training capabilities

-

Model registry and versioning

-

A/B testing for models

-

Ethical AI governance frameworks

-

Reinforcement learning capabilities

7. Autonomous Decision Intelligence

The human impact: “The AI doesn’t just alert us to problems; it solves them,” explains operations manager Amira Saffori. “Last month, our system detected an unusual pattern in ATM withdrawals, automatically adjusted security parameters for affected locations, and notified law enforcement, all before our morning team meeting.”

Technical requirements:

-

Complex event processing engines

-

Decision intelligence platforms

-

Process mining and optimization

-

Predictive analytics infrastructure

-

Digital twins of critical processes

-

Explainable AI components

-

Human-in-the-loop workflows for exceptions

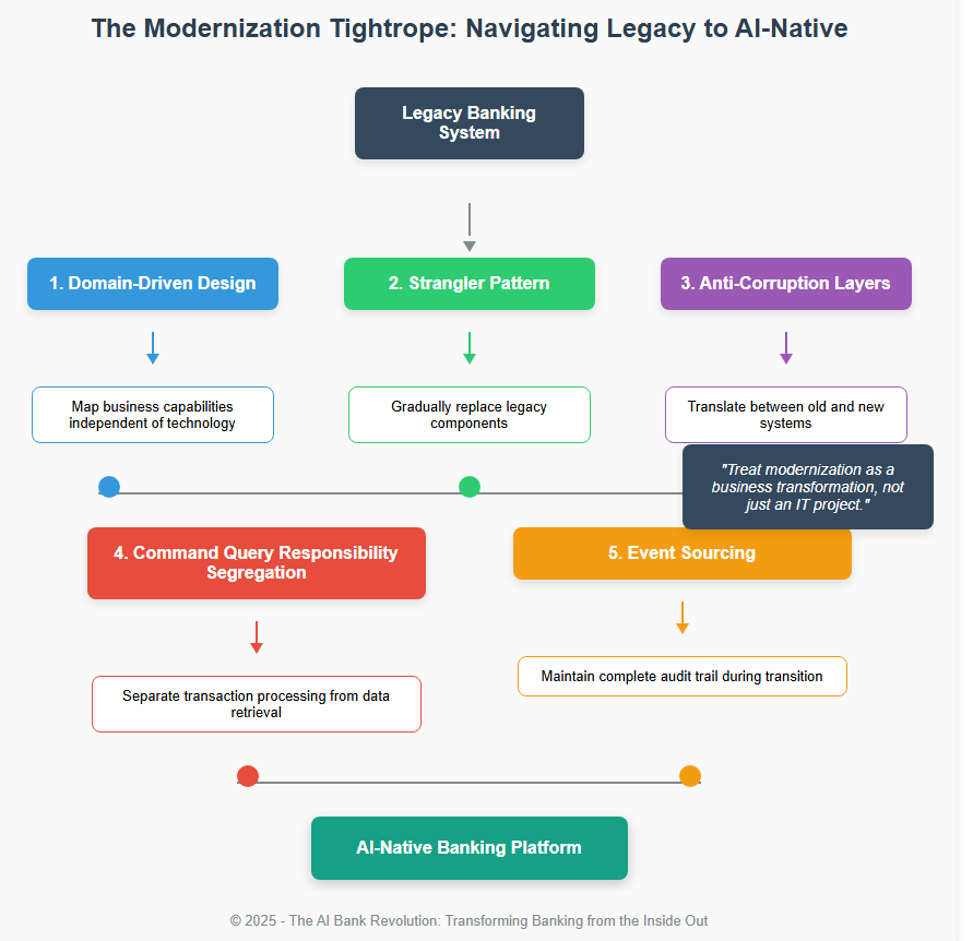

The Modernization Tightrope

The greatest challenge for established banks isn’t understanding the destination; it’s navigating the journey while keeping the lights on. Unlike fintech startups building on greenfield technology, traditional banks must perform open-heart surgery on systems that process trillions of dollars daily.

The Competitive Landscape

The race to enable AI-native banking has attracted technology giants, specialized providers, and cloud hyperscalers alike. While each brings unique strengths to the table, several companies have emerged as leaders in this transformative space:

Cloud Hyperscalers with Financial Services Focus

Google Cloud: Its Banking Data Platform combines cloud infrastructure with specialized data analytics for financial institutions. Google’s acquisition of Anthropic and its Claude AI models positions it strongly in the generative AI space for banking applications.

Microsoft Azure: With its Financial Services Cloud and recent partnership with OpenAI, Microsoft offers a comprehensive solution spanning cloud infrastructure, data platforms, and advanced AI capabilities tailored for financial services.

AWS: Amazon’s financial services cloud includes purpose-built services for banking transformation, while its collaboration with Databricks provides advanced analytics capabilities critical for AI workloads.

Core Banking Modernization Specialists

Temenos: A market leader in core banking platforms, Temenos has invested heavily in AI capabilities, offering both cloud-native core systems and integration paths for existing infrastructure.

Thought Machine: Founded by former Google engineers, Thought Machine’s Vault platform was built from the ground up as a cloud-native, API-first core banking system designed specifically for AI integration.

Mambu: Its composable banking approach allows institutions to modernize incrementally while maintaining legacy systems, with strong support for AI integration through open APIs.

Infrastructure and Systems Integration Leaders

IBM: Leveraging decades of mainframe experience, IBM’s approach combines hybrid cloud infrastructure with Watson AI capabilities and specialized financial services offerings.

Huawei: Huawei’s Digital CORE Solution provides a comprehensive framework bridging legacy systems with modern cloud and AI capabilities, with particular strength in high-performance infrastructure.

Oracle: Its Financial Services Cloud and modern core banking offerings combine database expertise with specialized financial applications supporting AI workloads.

TCS: The BaNCS platform combines core banking modernization with AI capabilities, supported by TCS’s extensive systems integration experience.

Specialized AI Banking Technology Providers

Personetics: Focuses specifically on financial data-driven personalization and customer engagement through AI.

Feedzai: Specializes in real-time risk management and fraud prevention using advanced AI techniques.

Kasisto: Offers conversational AI specifically trained on banking domain knowledge.

Choosing the Right Partner for Your AI Journey

With so many players in the market, banks face the challenge of selecting the right partners for their unique modernization needs. The most successful transformations typically involve multiple partners forming an ecosystem rather than a single-vendor approach.

The right partner mix depends on your starting point and destination. Banks with heavy mainframe dependencies might leverage IBM or Huawei's expertise in bridging legacy systems. Those ready for more comprehensive transformation might choose cloud hyperscalers with specialized banking partners.Key selection criteria should include:

-

Legacy integration expertise: How effectively can they connect with your existing systems?

-

Regulatory compliance: Do they understand your regulatory landscape and data sovereignty requirements?

-

Performance at scale: Can their solutions handle your transaction volumes with five-nines reliability?

-

AI/ML capabilities: What specific AI capabilities do they offer for your priority use cases?

-

Ecosystem approach: Do they maintain an open architecture that allows you to work with specialized partners?

-

Implementation methodology: Do they offer a phased approach that delivers value while minimizing risk?

A Blueprint for Modernization

Among the many solutions available for modernizing legacy systems, comprehensive approaches like Huawei’s Digital CORE Solution stand out by transforming traditional infrastructure into an agile, resilient, and open distributed system. The most effective solutions integrate across six key domains:

-

Cloud: Scalable infrastructure for real-time processing

-

Middleware: Seamless communication between systems and applications

-

Databases: High-performance, distributed databases for instant data access

-

Storage: Reliable and scalable storage solutions

-

Networking: Fast, secure, and redundant networking capabilities

-

System Engineering: Robust design principles for fault-tolerant systems

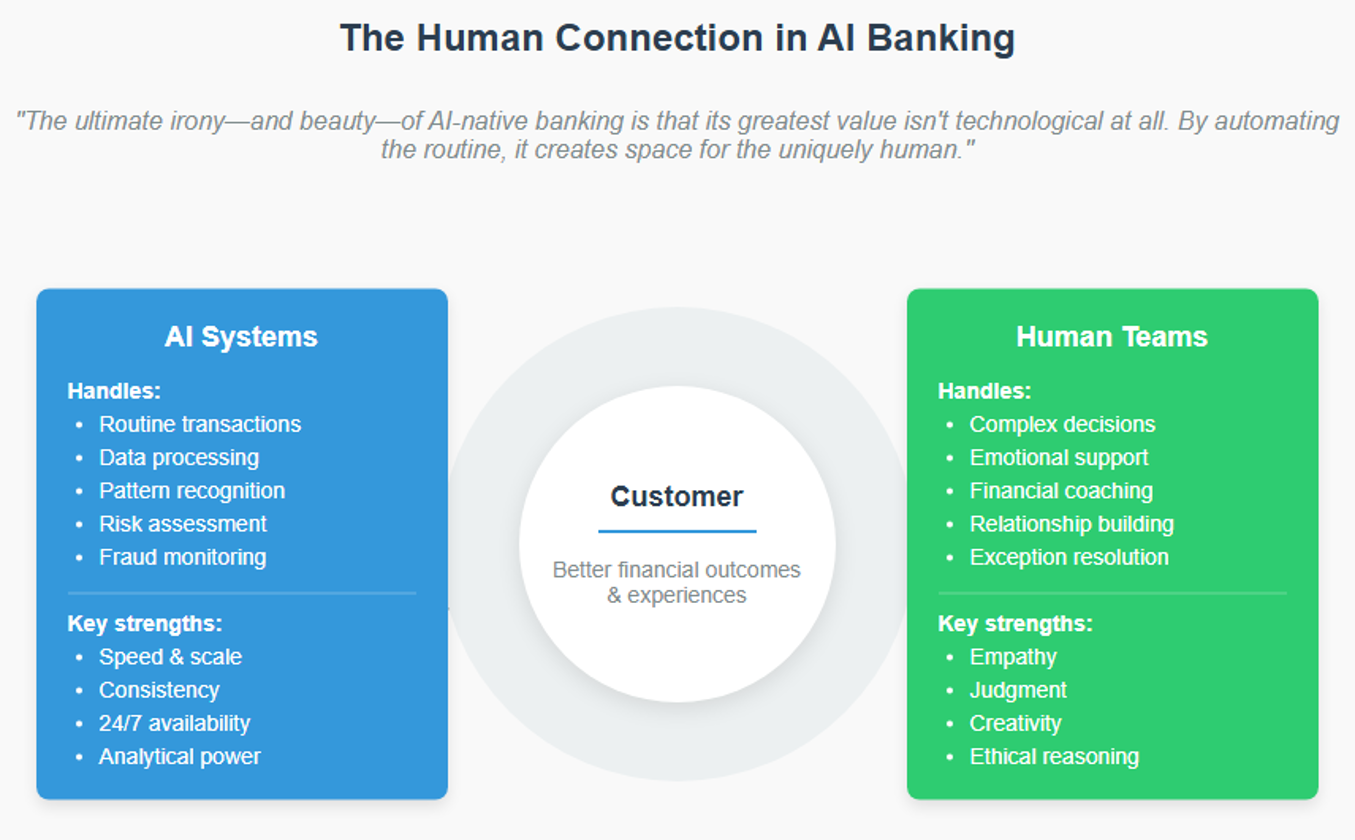

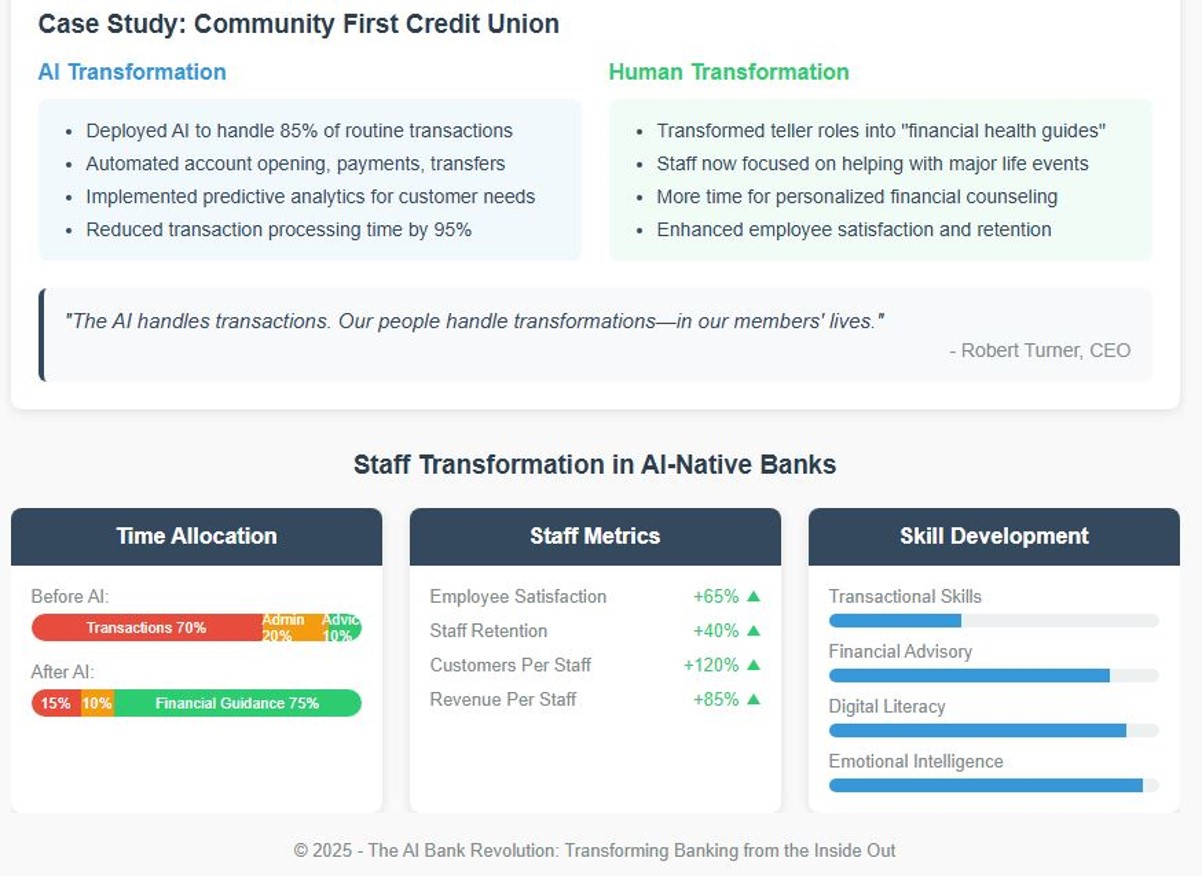

The Heart of AI-Native Banking

The ultimate irony and beauty of AI-native banking is that its greatest value isn’t technological at all. By automating the routine, it creates space for the uniquely human.

The Time for Transformation is Now

The journey to AI-native banking won’t be easy. It demands technical expertise, cultural evolution, and strategic vision. But for banks willing to embrace this transformation, the rewards extend far beyond operational efficiency.

Success in AI-native banking ultimately hinges on three critical factors:

-

Timing: Banks must act swiftly to modernize their infrastructure and adopt AI. The longer they delay, the harder it will be to catch up with competitors.

-

Approach: A phased, well-planned approach to modernization is critical. Banks should prioritize high-impact areas like fraud prevention and personalization while gradually transforming their core systems.

-

Partnerships: Choosing the right technology partner is crucial. Partnerships with organizations that offer proven digital transformation solutions can significantly accelerate the modernization journey.

In an age of digital commoditization, AI-native banks can deliver something truly valuable: financial services that understand human needs, adapt to individual circumstances, and enable better financial lives.

The future of banking isn't just intelligent; it's empathetic. And that future is arriving now, one bank at a time.Are you ready to be part of the revolution?